Ombudsman reads the riot act to WorkSafe Victoria & insurers

A report by the Victorian ombudsman has delivered scathing criticism of the records and information management practices of WorkSafe Victoria and the six major insurance companies it authorises to manage workplace claims – Allianz, CGU, Gallagher Bassett, GIO, QBE, and Xchanging.

Outdated information technology systems, inadequate file maintenance and inadequate understanding of statutory obligations were highlighted as the reasons for the substandard recordkeeping.

The Ombudman found that poor record keeping at the insurance companies caused delays in payments, breaches of privacy and resulted in manipulation of the WorkSafe incentive scheme for agents.

Ombudsman George Brouwer told the Victorian government that the number of complaints about WorkSafe and its agents has increased over the past three years by 27 per cent, and the trend appears to be continuing this year.

It found that staff at CGU had been involved in a practice that artificially distorted the the WorkSafe incentive scheme for agent. WorkSafe has since fined CGU $2.8 million, and CGU has agreed to make restitution for $2.5 million.

It found that staff at CGU had been involved in a practice that artificially distorted the the WorkSafe incentive scheme for agent. WorkSafe has since fined CGU $2.8 million, and CGU has agreed to make restitution for $2.5 million.

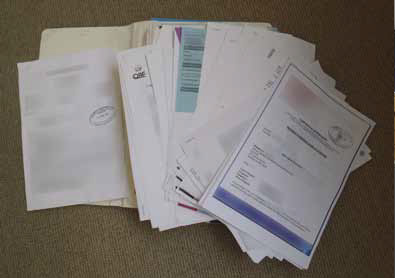

Mismanagement of workers’ files has led to medical reports and other information being sent to third parties in error, and the report showed evidence of files kept in a state of disrepair.

“With the exception of QBE and GIO, the physical files inspected:

• were in poor order, not folioed and contained loose documents

• contained incorrectly filed documents, unrelated to the claim or the claimant contained a lack of contemporaneous notes of conversations and meetings

• were poorly secured with documents and files housed at officers’ work stations and not secured overnight.

“The management of these files is unacceptable and creates a risk of documents being lost, destroyed or allocated to the wrong file. The private and often very personal information of injured workers being kept in such a

state is of concern.”

The report found much to blame in the IT infrastructure.

“The WorkSafe scheme is administered using inadequate information technology (IT) systems. One of the two IT systems that underpin the entire WorkSafe scheme is a 25 year old DOS system called ACCtion. Developed in 1985, the ACCtion system is outdated and has limited capabilities. Managers from all agents considered that ACCtion is inadequate, calling it ‘archaic’, ‘insufficient’, ‘dated’, ‘antiquated’ and ‘inefficient’. All agency staff interviewed nominated upgraded IT systems as their highest priority. “

The Ombudsman’s report criticised the insurance companies for their lack of awareness of requirements under the Public Records Act, as well as their storage of physical files.

The Ombudsman’s report criticised the insurance companies for their lack of awareness of requirements under the Public Records Act, as well as their storage of physical files.

On numerous visits to the insurance companies it fond examples as follows: “Files inspected by my officers were in a state of disorder. Files had loose documents, torn covers and were overfull. Files at Allianz were stored on shelving which were not capable of being locked. CGU’s files were stored in lockable cabinets. However there were files stored on top of these cabinets and my officers were advised that these cabinets are not generally locked at night. Files inspected by my officers were in a state of disorder. “

However the Ombudsman found insurer QBE was a shining light.

“QBE has implemented an electronic file system and as such does not have physical files. All physical documents relating to a file are scanned into the electronic system by an external

contractor and then stored off-site. In place of a physical file QBE maintains the correspondence related to files on an electronic IT system called Automated Workflow Distributor.

“With the exception of QBE, none of the agents scan or record incoming or outgoing mail. Therefore the physical file houses the only record of correspondence that relates to the claim and used by the agent to manage the claim. Such correspondence includes medical reports and certificates relating to the injured worker; legal documents concerning legal proceedings;

surveillance reports undertaken for the agents monitoring the activities of injured workers; and relevant referrals for treatment.

The Ombudman’s report also found much to criticise in the email management and filesharing protocols at the insurance companies. The report reads like a basic textbook for modern enterprise content management.

“The personal email accounts of case managers often record and store email communication with employers, injured workers, service providers and WorkSafe. Although my investigators were advised that emails relating to a case are meant to be copied and recorded on the Novus system or the physical file, my investigators found few emails on either Novus or the physical files examined at any of the agents.

[Worksafe responded: Agents have always operated with their own e-mail systems and a technical solution may not be possible in the short term. Where a worker e-mails information directly to a claims officer the work practice is that a hard-copy of the email should be then placed on the physical file or an e-copy of Novus]

“Complaints from injured workers, employers or service providers were rarely recorded on the claim file, if at all, and were kept on a separate system at many of the agents. Allianz, Xchanging and CGU advised that written complaints were kept on file after they were actioned. During file inspections, my officers found this was not the case at these

agents.

“Records and the details of privacy breaches are also kept separately from the injured worker’s claim file.

“Claim-related letters for which no templates exist are created by case workers and are stored on shared hard drives on the agent’s computer network under the case manager’s name, not the injured worker’s name.

“Accounts and invoices, whether paid or otherwise, are not usually retained on the physical claim file once they are actioned by the accounts team. They are kept in a separate storage area.

“My investigators found that it was difficult to review individual case/claim management given the difficult information systems that needed to be searched. A manager from Gallagher Bassett said: ‘The difficulty with the whole administration is that the information can be in many places with regards to the file.’”

[Worksafe responded: While managing millions of documents and around 56,000 active claims each year is never easy in a system like ours, WorkSafe recognises there is room for improvement.]

A full copy of the Ombudsman’s report is available HERE.