Surveying the collaboration battleground

Matthew Moore and Keith De La Rue set out on a mission to determine what's really happening in the market for collaborative software in Australia.

In June 2009, we set out to assess the state of play in the collaborative software market in Australia. We wanted to get behind the hype of the “collaboration” buzz-word to discover how organisations are selecting and implementing these tools, and whether they are benefiting from them. We used an online survey to collect our data, and received 42 responses. In the following article, we will present some of our high-level findings.

We began by asking our respondents to define the term “collaboration” in the first place. To give you some idea of the responses, we have put the text through Wordle, an online tool that creates ‘word clouds’ from text based on the frequency of words within that text (see right).

The responses were fairly rich and varied, but a recurrent theme was “people working together”. Examining each element of this in turn:

* “People.” Collaboration is fundamentally about human beings. Later in the survey, we asked respondents what they would do differently if they could run their collaboration projects again. They repeatedly stated that the staff affected by the software implementation should have been engaged earlier in the process.

* “Working.” Collaboration software needs to support existing work, as well as offer opportunities for new and improved work practices. If it is not aligned to work efforts then it will fail. There is no “nice to have” option. The presence of words like “achieve” and “goal” reinforces this.

* “Together.” This final word is a major challenge for many organisations. Individuals, teams and business units have often been rewarded for working autonomously. They win or lose alone.

However as markets become more complex, so the need for collaboration increases. Complex problems cannot be solved by one individual, no matter how smart. This requires a change in work practices as well as the availability of software.

Nearly all the respondents had either implemented collaboration software or were planning to within the next 12 months - only two were not. However, despite all this activity, over two-thirds of respondents said that their organisation does not have a formal collaboration strategy, with one-third saying that there isn’t even an informal one. There was also no clear winner on who sets whatever strategy there is - IT, support functions such as HR or KM, lines of business and corporate head office all figure in the results.

Given the diversity of the collaboration software landscape, this lack of focus could potentially indicate trouble ahead for many organisations.

Looking at the stated reasons for the organisations’ interest in collaborative software (summarised in the chart below) there was an emphasis on team productivity. This is not surprising, as team collaboration is a frequent use case for many vendors.

The next most popular response was “improving decision-making”. This suggests that there is an opportunity for vendors to combine collaboration platforms with other tools that can support decision making such as business intelligence and even prediction markets. Given the recent economic worries, cost-reduction was placed surprisingly low on the list. Business cases that focus on notional headcount reductions may not be the best way to frame the benefits of a collaboration tool.

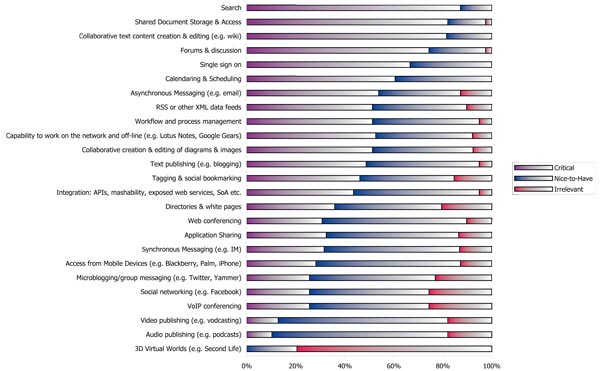

We then asked our respondents to identify the key functions they expected from their collaboration solution.

“Search” emerged as the most critical, followed by “shared document storage and access”. This reinforces the need for vendors to offer the basics in their tools. The most popular “Enterprise 2.0” functionality to appear on the list was collaborative text content creation & editing.

This suggests that “the wiki way” is entering the business mainstream. Whether such functionality is explicitly badged as a wiki is probably less important than alleviating the pain of multiple versions of change tracking-enabled Word documents proliferating through email systems.

The “top six” list was filled out by forums and discussion, single sign-on and calendaring and scheduling. These last two highlight the importance of making it as easy as possible for people to do things – an often-underrated element in IT purchasing decisions. Generally, most of these functions are now quite mature – there seemed to be very little demand for cutting-edge technologies such as multi-media publishing or 3D virtual worlds.

When looking at the vendors used, we found quite a crowd. When asked what tools they had considered, 27 respondents named over 50 products.

Microsoft’s SharePoint and Atlassian’s Confluence were the two most popular products named, but it’s a space with no clear leaders – with both commercial vendors (e.g. SAP, Documentum, Salesforce) and open source (Drupal, MediaWiki) in use.

Many of the tools named would probably not even identify the others as competitors in their market. Some tools mentioned have specific applications - e.g. higher education learning management or product lifecycle management.

While the indications are that SharePoint will continue to occupy the middle ground of the collaboration software market, it is unlikely to present a serious challenge to specialist vendors in the near future and gaps in its functionality will allow more agile direct competitors to flourish.

The last part of the survey was broken out into four streams, focussed on respondents engaged in different stages of the system life-cycle – identification, selection, implementation and operation.

We looked at our respondents’ satisfaction with the process at each stage. Most of these responses were somewhat neutral to ambivalent, but in general, the experiences during implementation and operation were more positive.

When embarking on a collaborative project, be clear on what your needs are first, make sure everyone is clear on what they are supposed to be doing with it once you get it, and realise the importance of getting each stage right the first time.

There seemed to be a strong indication that most respondents sought help of some type. In general, more help was sought during the earlier stages; but more than half of the respondents have had help at some stage, whether from vendors, consultants, or other parts of their own organisation. This perhaps indicates that none of this is easy, even for professionals.

The final area of interest from the survey is looking at what people would do differently if there was a next time. The results here were quite varied, but again some trends emerged.

Some key conclusions can be summarised as follows:

* A different approach is required from IT departments and decision-makers;

* It takes time, needs a strong focus on the needs of the people who will use the system –and you must ensure that these needs are met;

* It needs senior-level support, and recognition of the benefits of appropriate investment;

* Be very clear on each part of what you need, and how the parts will work together;

* Be clear on what you expect to happen when you put the system into place;

* Ensure that everyone receives training, and is fully engaged in change; and

* Don’t be afraid to ask for help.

Finally, we distilled some strong key-words out of this part of the survey. If you are thinking of investing in a collaborative system, write these words down somewhere, and look at them at every stage of the process: people, engagement, change, time, scope, benefits, training, structure, support and features. Ignore these at your peril!

The key findings of the survey have been published at http://ozcollab.com/.

Matthew Moore is director of Innotecture (http://innotecture.wordpress.com/), a consultancy that focuses on KM and collaboration. He has worked in KM for over a decade, with organisations such as PwC, IBM, Oracle and the Australian government.

Keith De La Rue is principal consultant at AcKnowledge Consulting (http://acknowledgeconsulting.com/), focusing on KM, communication and learning. He has worked in KM for 10 years, including eight years in product, marketing and sales areas at Telstra.