EU countries are trailing the US in “digitalisation”

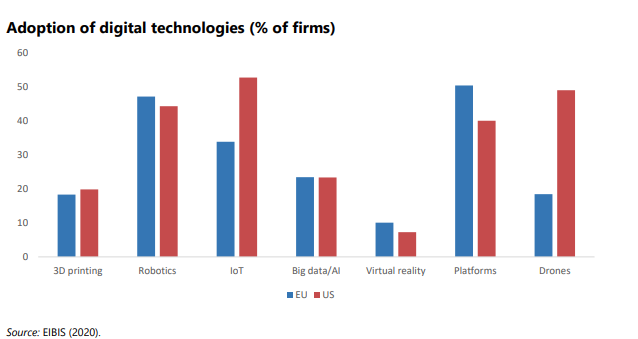

An annual survey of some 13,500 firms in the European Union (EU) has found it is lagging behind the US in digital transformation, as 37% of European firms had still not adopted any advanced digital technology by 2020, compared with 27% in the United States.

The EIB Investment Survey (EIBIS) is undertaken each year by European Investment Bank (EIB), owned by EU Member States. It surveys firms in all EU Member States, as well as a sample of US firms which serves as a benchmark.

It found the Digitalisation gap between the United States and European Union remains, although eight EU countries now outperform the United States.

During the COVID-19 crisis in 2020, many EU firms were not implementing any digital technology and had no plans to invest in their digital transformation.

In particular, Europe’s smaller companies slowed down their digital adoption.

It waned the slow adaptation of digital technologies threatens to impede European firms’ competitiveness in the long term, as digital firms tend to perform better than non-digital firms do.

“They invest more, are more innovative, have better management practices, grow faster and create higher-paying jobs. Digital firms are also more likely to invest in tackling the transition and physical risks of climate change. While EU firms are overall lagging behind US peers in adopting and creating new digital technologies, Europe excels in one area — the intersection of green/digital technologies,” the report notes.

“The pandemic has shown us the advantages of being digital. That is why we need to be concerned about the slow speed of digitalisation by EU firms. The gap with the US not only jeopardises our long-term competitiveness. A weak European digital sector also means that we will lack ownership of our data,” said EIB Vice-President Ricardo Mourinho Félix.

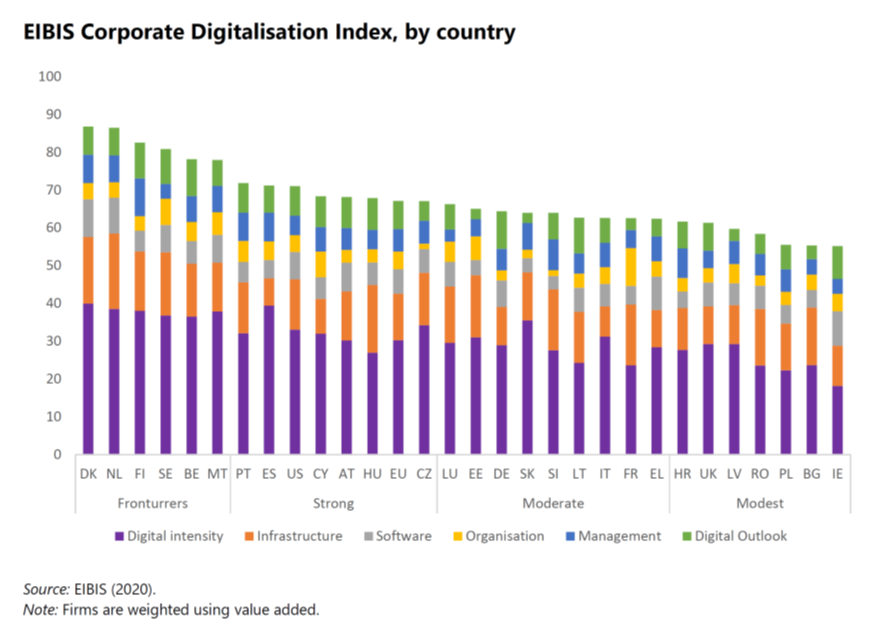

The EIB Corporate Digitalisation index: Digital adoption in the European Union and the United States.

The index shows that, on average, the European Union fell short of the United States during the first COVID-19 lockdowns in 2020. However, there were several EU countries that outperformed the United States: Spain, Portugal, Belgium, Sweden, Finland, the Netherlands and Denmark.

The European Union’s digital gap with the United States is particularly severe for smaller firms with fewer than 50 employees. In the European Union, 60% of micro firms (five to nine employees) have not implemented any digital technologies, while 75% of large firms (with more than 250 employees) are already digital. The relationship between firm size and digital adoption rates can be observed in all sectors.

A key factor contributing to the slow adoption of digitalisation by small firms is a lack of the right set of skills to embrace these new technologies. Although a lack of access to finance is not a major impediment to investment in the European Union, it can be a barrier to the adoption of digital technologies for small firms.

Microenterprises and small and medium-sized companies are the backbone of the European economy and represent 99% of all businesses and more than two-thirds of employment in the European Union, compared with slightly more than 40% of employment in the United States. As such, the difference in the number of small firms contributes to the digitalisation gap between the two economies.

The report also found the European Union is lagging behind the United States not only in digital adoption but also in digital innovation. EU firms are trailing both the United States and China in terms of patent applications for “industry 4.0” technologies and this gap has been widening over time (EIB, 2021). For example, employment and revenues of firms that file patents in the field of artificial intelligence tend to grow much faster (Alderucci et al., 2020). While some Chinese firms are becoming serious digital global players, the GAFAM (Google, Amazon, Facebook, Apple and Microsoft) are all US firms, which confirms the supremacy of the United States in patent applications for digital technologies.

Read all recommendations and the full report here