Peppol. What is it, and how will it help my business?

Over the past few months, we’ve seen some important announcements made by the Australian Government in relation to e-invoicing. The main being its commitment of $15.3 million to accelerate e-invoicing and support the Treasury and the Australian Peppol E-Invoicing Authority (run by the ATO).

That announcement followed similar pushes towards e-invoicing from the Federal government over the past 12 months. With e-invoicing becoming mandatory for all New South Wales Federal agencies by 1st July 2022, for example.

The carrot that is being dangled by both the Federal and NSW governments is that if suppliers send their invoices as an e-invoice, the relevant agencies will guarantee accelerated payments terms of 5 days – a huge cashflow win for any business. So, while e-invoicing is clearly the future in Australia, do Australian businesses understand what e-invoicing or Peppol really are, how it all works, and how it might affect them? To clear some of the flog, let’s start with the basics:

What is e-invoicing?

Over 1.2 billion Business to Business (B2B) and Business to Government (B2G) invoices are exchanged annually in Australia. Most of those invoices are sent either as paper invoices or as PDF invoices attached to an email. These are costly ways to process invoices with manual data entry or validation usually required. The Australia Tax Office (ATO) estimate that the average invoice processing cost for a paper invoice is $30.87, while the average invoice processing cost for a PDF invoice is $27.67.

Most of the difference is based on the usual manual work required to enter the invoice data into your systems and process it for approval and payment. Electronic invoicing (or e-invoicing) automates that process, automatically exchanging any invoice data directly between a buyer’s and supplier’s systems, removing the need for any manual data entry or validation.

The ATO estimate that automation can reduce the cost of processing an invoice down to $9.18 and that e-invoices are 66% cheaper to process than PDF invoices. In fact, the NSW Government estimated a shared saving between suppliers and the NSW government of $71m based on the 4.2 million invoices across NSW Government in 2019.

Do PDF invoices qualify as being e-invoices? If they don’t, what does?

No, PDF invoices can be sent to someone electronically via e-mail, so it’s not a system-to-system exchange of data, which would remove the need for any manual data entry or processing. E-invoices are not a new concept, they have been around for a while, in several different formats, standards and names. Typically, they have been focussed on connecting a buyer with a supplier.

E-invoicing systems have historically been quite expensive and time consuming to setup – this meant that it was largely only looked at by large businesses who had a big volume of orders or invoices. The lack of a consistent and single format and framework for e-invoicing has kept it from going mainstream.

The turning point for e-invoicing has been the adoption of a globally recognised standard for sending e-invoices and e-orders known Peppol (Pan-European Public Procurement OnLine). This standard enables anyone who is part of the network to easily and safely, send e-invoices and e-orders to each other.

The standard also enables a simple and accessible way for businesses to be onboarded onto the network. There are already 200,000+ businesses across 34+ countries on the Peppol network. Australia, New Zealand and Singapore have all adopted the Peppol standard as the basis for their e-invoice mandates.

What is Peppol?

Peppol is a globally recognised standard and process for exchanging e-invoices and e-orders and is currently used in 39 countries across the world. Peppol e-invoicing works by suppliers and buyers sending their invoices or orders through their systems to a certified Peppol Access Point.

The Access Point verifies the data on the invoice or order and then sends it on to the receivers certified Access Point who transmits the data into their system. This means that data is shared almost instantly into the receiver’s system without any manual data entry or manipulation required. In essence, Peppol provides a secure and easy gateway for businesses to send invoices or orders in a way that talks directly to the systems that need it.

What is a Peppol Access Point?

A Peppol access point is what your system connects to, so it can send and receive information to other businesses access points in the network. Put simply, an access point is like your mobile phone number, it can be provided by any carrier, but it is able to send and receive calls and messages to any other carrier all on the same network. This means that once you are connected to an access point you will be able to send and receive e-invoices or e-orders to any other business that is connected to the network without any extra work.

What are the benefits of e-invoicing?

The Australian government believes that e-invoicing can save the economy $28bn over 10 years. Sounds great, but what are the actual benefits and why would businesses want to be able to send and receive Peppol e-invoices? The first thing to consider about Peppol e-invoicing is how you are currently processing invoices.

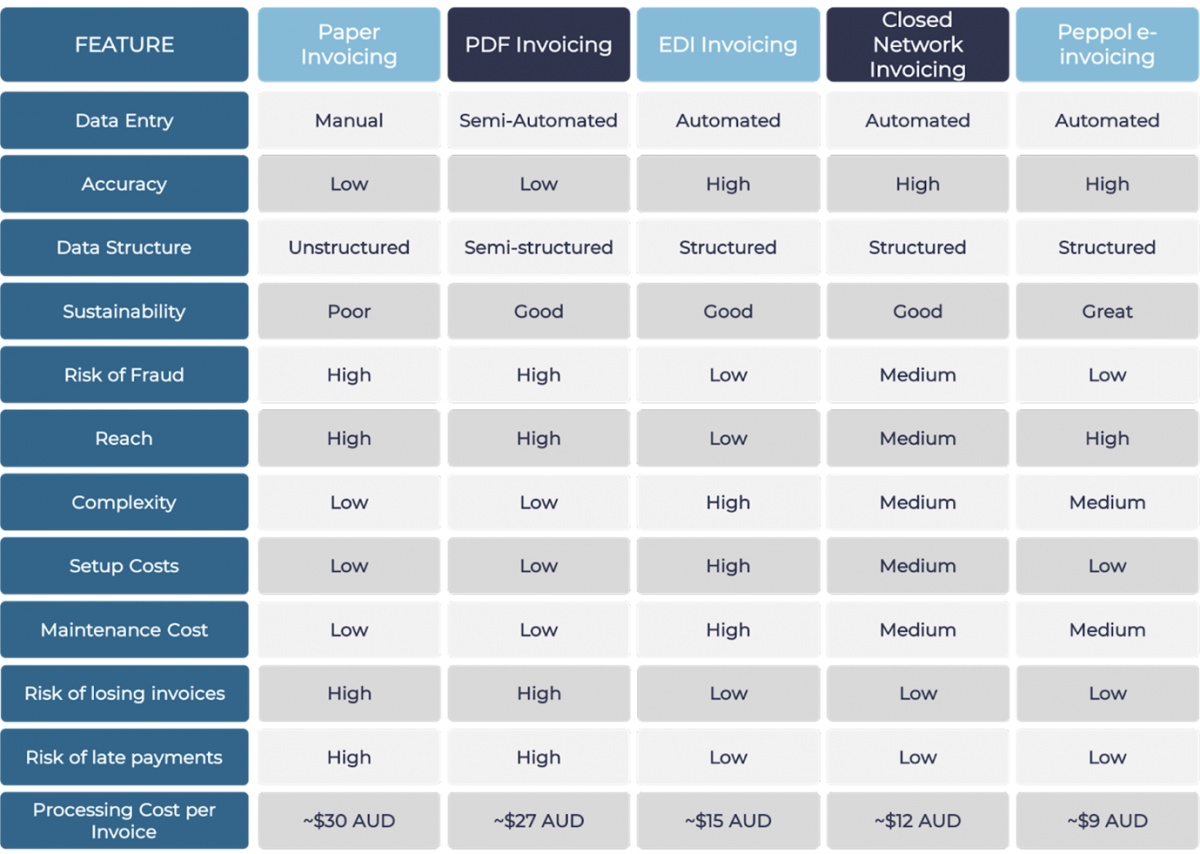

Our resident e-invoicing experts pulled together a detailed overview of how invoicing has evolved and assessed each evolution of that option across a number of key factors:

Depending on which invoicing method you are currently using, the benefits of shifting to Peppol e-invoicing can be huge. Typically, we find that Peppol e-invoicing (and e-ordering) can help support businesses with a range of challenges they face today:

Problem: Large supplier base making invoice automation impossible and too expensive

Utilising Peppol e-invoicing, once you are connected to the Peppol network through an Access Point, you are automatically connected with every other buyer and supplier in the network - greatly enhancing your ability to automate invoice processing with all your suppliers. If your trading partner is not on the Peppol network yet, we can help onboard them which doesn’t require any investment from you or your trading partners.

Problem: High Risk of Invoice Fraud

PDF invoices can easily be intercepted mid-flight and manipulated before being received by the buyer and email compromise scams like this are on the rise, a topic we wrote about recently. With Peppol e-invoicing, the sender is validated to ensure they are who they say they are and that bank account details match your records before transmitting the data through the Peppol network.

The network itself is highly secure as only accredited Peppol Access Points providers can exchange the documents over the Peppol network. Access providers like us are required to meet strict security protocols equivalent to ISO27001 covering intrusion prevention, multi-factor authentication for privileged user access and data encryption to ensure the security of the network.

Problem: Cash Flow Management during the Pandemic

Businesses can be crippled when buyers pay them late, invoices can get missed when it's reliant on human intervention. Equally, buyers can miss out on early payment discounts if the invoice is lost or not processed quickly. E-invoicing speeds the whole invoice processing piece up for both sides, removing the worry of whether an invoice has been received and processed or not. In Australia, Commonwealth and NSW government agencies guarantee 5-day payment terms for e-invoices which makes e-invoicing even more attractive.