How Enterprises Are Building and Buying GenAI

American venture capital firm Andreessen Horowitz has published a report examining the uptake of Generative AI by large enterprises. Authors Sarah Wang and Shangda Xu spoke with dozens of Fortune 500 leaders, and surveyed 70 more.

They found that those surveyed still have some reservations about deploying generative AI, they’re also nearly tripling their budgets, expanding the number of use cases that are deployed on smaller open-source models, and transitioning more workloads from early experimentation into production.

They claim budgets for generative AI are skyrocketing, with the average spend in 2023 across foundation model APIs, self-hosting, and fine-tuning models $US7M.

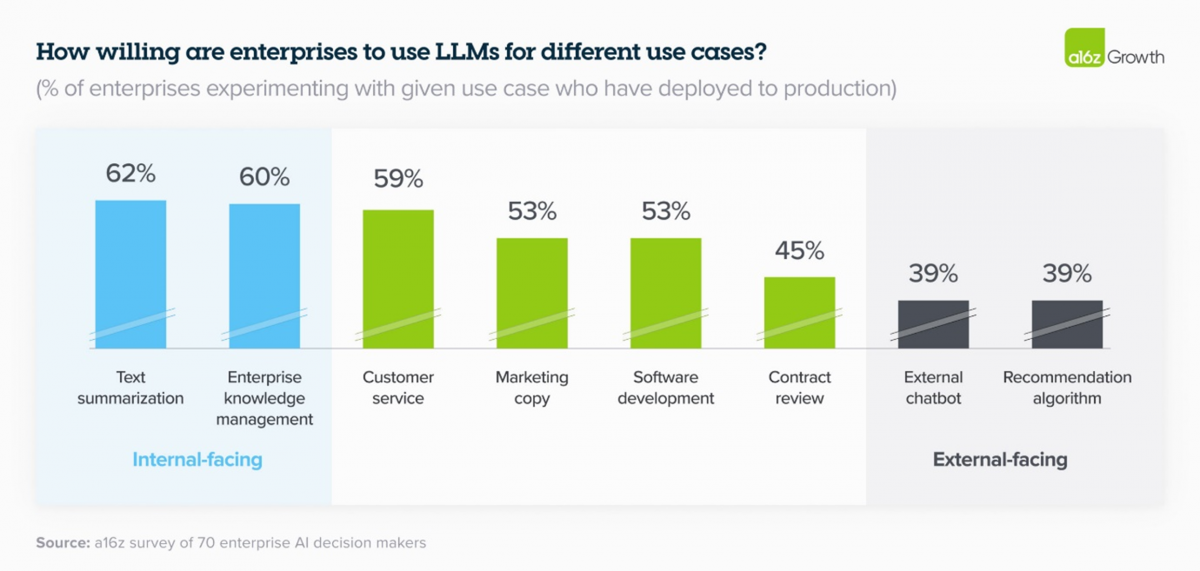

Also, they noted enterprises are excited about internal use cases but remain more cautious about external ones.

“That’s because 2 primary concerns about GenAI still loom large in the enterprise:

1) potential issues with hallucination and safety, and

2) public relations issues with deploying GenAI, particularly into sensitive consumer sectors (e.g., healthcare and financial services).

“The most popular use cases of the past year were either focused on internal productivity or routed through a human before getting to a customer—like coding copilots, customer support, and marketing.

“As we can see in the chart below, these use cases are still dominating in the enterprise in 2024, with enterprises pushing totally internal use cases like text summarization and knowledge management (e.g., internal chatbot) to production at far higher rates than sensitive human-in-the-loop use cases like contract review, or customer-facing use cases like external chatbots or recommendation algorithms.

“Companies are keen to avoid the fallout from generative AI mishaps like the Air Canada customer service debacle. Because these concerns still loom large for most enterprises, startups who build tooling that can help control for these issues could see significant adoption.

The report’s authors believe the total spend on model APIs and fine-tuning will grow to over $US5B by the end of 2024, and enterprise spend will make up a significant part of that opportunity.

The full report is available HERE.